How Global Wealth Builders Ltd. Manages Your Money

We believe that our clients’ portfolios should be protected from excessive volatility and market risk. Passive, buy & hold strategies fail to do so.

When you have read this discussion, we believe you will agree that there are compelling reasons why investors seeking wealth management services choose Global Wealth Builders Ltd.

Investors recruit us to manage risk and provide competitive returns.

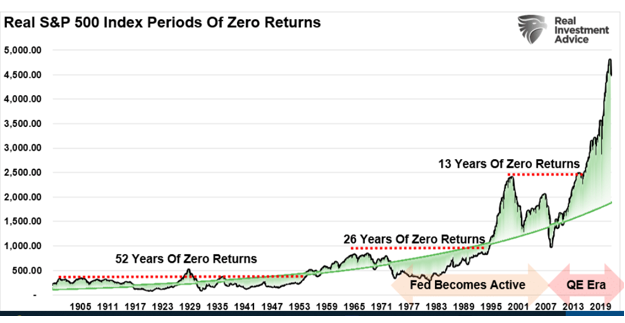

Many wealth managers promote “long-term” investing. This is a mistake. The history of financial markets does not support a passive “Buy & Hold, long-term strategy. Historically, it has taken many years before the markets recovered to pre-correction levels. For example, it took 13 years to recover from the 2009 correction. Previous corrections took longer.

Such long periods of zero returns interrupt the compounding factor and seriously increase the total loss.

Most investors lost money in 2022 because their portfolios lacked risk management. Sadly, they will lose more in the future if risk is not addressed. Our portfolios were well protected from the collapse.

The mix of investments must be adjusted so a portfolio is positioned in those assets which perform the best through the ups and downs of the business cycle.

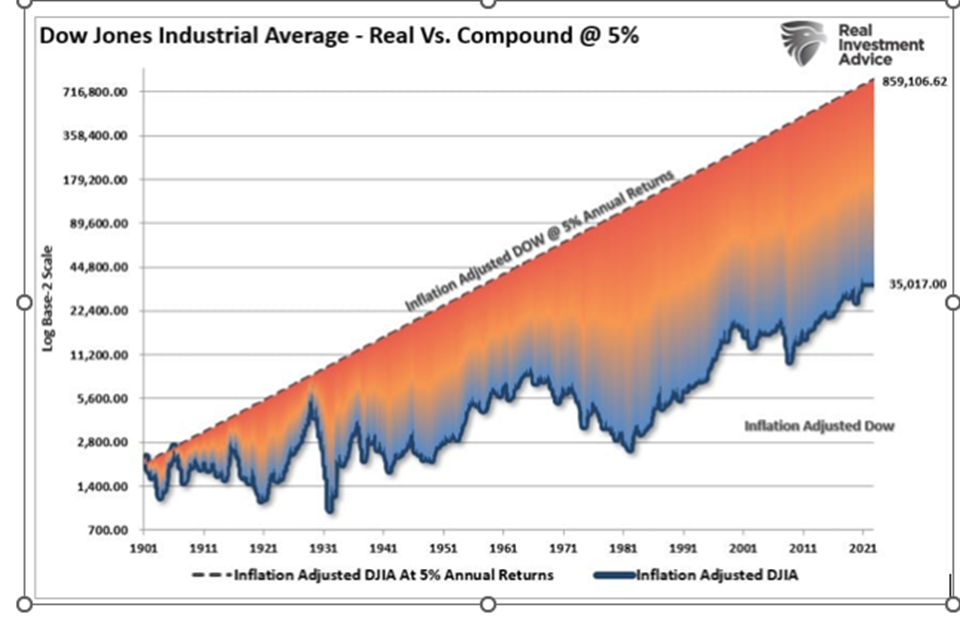

The charts below dramatically illustrate the seriousness of the damage done to portfolios that do not manage risk and address the business cycle.

This chart shows the devastating cost to a portfolio caused by the interruption of the compounding factor under a buy & hold strategy.

A 5% return since 1900 produced 24 times the gains of the Dow Jones average, because the compounding factor was not interrupted by market corrections.

The graph below shows the long periods of zero returns following past corrections. Indeed, compounding was interrupted for 91 of 123 years.

These two graphs clearly debunk the long-term, buy & hold strategy.

Our Risk management disciplines effectively cut losses and capture accrued gains.

We continously monitor the fundamental and technical performance of our stocks to manage risk and capture profits. Our system uses stop losses extensively. This activity is designed to reduce portfolio volatility, manage risk and improve portfolio returns.

Our Investing Process:

Strong Financial markets are driven by the following “essential conditions”:

Earnings are growing.

Inflation is low.

Interest rates are low.

We act to defend capital when these conditions are fading and not supportive.

Stock buying disciplines:

- Only buy stocks that are rising, and the market is rising.

- The Stock price is below or near intrinsic value.

- Is it safe? Indicated by trading history and pattern of volatility.

- Record of persistent earnings growth.

- Supported by measures of valuation, safety & timing.

- Buying, is confirmed by our computer system.

- Stock price is below resistance point.

- Timing indicators support the trade.

Rules for Selling a Stock:

- Price direction turning down, volatility high.

- Price falls below the 40-day moving average.

- Computer system recommends selling.

- The 5-day moving average breaks through the Relative Timing Indicator.

Risk Management Disciplines:

- Never give back more than 35% of accrued gains.

- Limit loss to no more than 1% of total portfolio value.

- Review a stock when it moves from “buy” to “hold”.

- Weed out underperforming stocks.

- Sell when system recommends selling.

- Act to defend capital when Earnings Growth slows, Interest rates are rising, and inflation is rising.

These disciplines translate into less risk, improved returns, and less volatility. It makes no sense to passively watch portfolio values melt down.

Reporting System:

We provide detailed disclosure of all activity in the portfolio.

We are knowledgeable about economic and market conditions and prepared to discuss them at any time.

Our Fees:

Our contract provides authority for your custodian to pay our fees at each month’s end. Our fees are based on the average weekly market value of the portfolio as follows:

Annual Fee:

1.50% on the first $2 million market value. 1.00% on the next $3 million.

Negotiable Over $5 million.

About Fees:

By taking defensive action early in 2022, we protected capital sufficient to pay our fees for about 10 years. Normally, we expect to cover our fees by one or two trades.

Building a Portfolio

To build a portfolio, we screen all stocks to find the best opportunities. We seek stocks that are expected to return more than triple “A” rated corporate bonds over 1 to 3 years. These bonds are a logical alternative to owning stocks.

Having determined which stocks offer the highest potential gain, we then apply a variety of technical indicators to determine the best entry point. The portfolio is built one stock at a time. When a stock is held, it is monitored daily by applying the same criteria applied at the time of purchase. We monitor the price, volume, and trading pattern to manage risk and increase gains.

If a stock is underperforming, we recognize it very quickly and switch to a better opportunity. We try to avoid having dead money in the portfolio.

Closing Observations:

Experience proves that the long-term, buy and hold approach is high risk because it fails to maintain compounding, ignores the dynamics of the markets, the opportunity to increase returns and manage risk.

Adjusting a portfolio’s investments throughout the business cycle significantly increases returns. It is not market timing.

Most investors agree that our approach is sensible and offers an opportunity to get the most out of their portfolios and enjoy real peace of mind.

Please meet, call, or email me for more information.

Bruce Sansom

Global Wealth Builders Ltd. 780-488-2858 bsansom@gwealth.ca

We would welcome the opportunity to provide more information